Canada Post CUPW tentative agreements December 2025

In a development that anchors the Canada Post labor story for December 2025, Canada Post and the Canadian Union of Postal Workers (CUPW) announced the Canada Post CUPW tentative agreements December 2025. The agreements cover both the Urban and Rural and Suburban Mail Carrier (RSMC) bargaining units, marking a pivotal moment after more than two years of negotiations, public labor actions, and a formal Industrial Inquiry Commission process. The two parties described the movement as a major step toward restoring service stability for Canadians and preserving the postal system’s viability amid changing volumes and competitive pressures. The companies and CUPW indicated that the ratification process is now underway, with a commitment that there will be no strike or lockout activity during the ratification period. This news arrives just as the holiday mail season approaches, a period that historically tests postal networks’ resilience and the ability to deliver reliably under evolving operational models. The announcements emphasize that the tentative agreements are for five-year terms and would be in effect through January 31, 2029, a timeline that has implications for both workers and customers in the near term. (canadapost-postescanada.ca)

The announcements come after a long arc of negotiations and interim steps. In November 2025, Canada Post and CUPW indicated that they had reached agreements in principle, though the language of the contracts still required careful finalization before formal signing. The November milestone came amid a national labor dispute that included strikes by CUPW-represented workers in the weeks prior, and it followed an Industrial Inquiry Commission (IIC) process that examined delivery models, compensation, and the postal system’s longer-term viability. Reuters and other outlets documented the deal-in-principle status at that stage, highlighting that both sides would still need to settle contractual language and secure member ratification. The transition from principles to formal tentative agreements on December 22 represents a critical inflection point in a bargaining process that has reshaped Canada Post’s labor relations and strategic posture. (reuters.com)

The broader context for this development includes ongoing structural challenges at Canada Post, including a shift away from traditional letter volumes toward parcel and e-commerce deliveries, as well as policy and financial pressures highlighted by the Industrial Inquiry Commission several months earlier. The IIC’s findings, summarized in Canada Post materials, underscored the imperative for changes to the delivery model and the organization’s financial trajectory. While the final terms of the tentative agreements will be subject to ratification by CUPW members, the December 22 announcement signals an operationally meaningful step toward stabilizing wages, benefits, and work arrangements as the company pursues a more modern, flexible delivery network. The evolving context—characterized by volume declines, elevated parcel competition, and the government’s financial support efforts—frames how these tentative agreements may influence service levels and labor relations in the year ahead. (canadapost-postescanada.ca)

Section 1: What Happened

Agreement scope and participants

Two bargaining units covered

Canada Post and CUPW announced tentative agreements for both the Urban and RSMC bargaining units. The interim terms cover the core group of front-line postal employees across urban postal operations and rural/suburban mail carriers, reflecting a comprehensive settlement across the spectrum of Canada Post’s workforce. The agreements explicitly note a five-year duration and an expiration date of January 31, 2029. This dual-unit reach is essential because both Urban and RSMC staff are central to daily mail flow, parcel delivery, and weekend operations that have become a focal point in ongoing modernization efforts. (canadapost-postescanada.ca)

Key terms at a glance

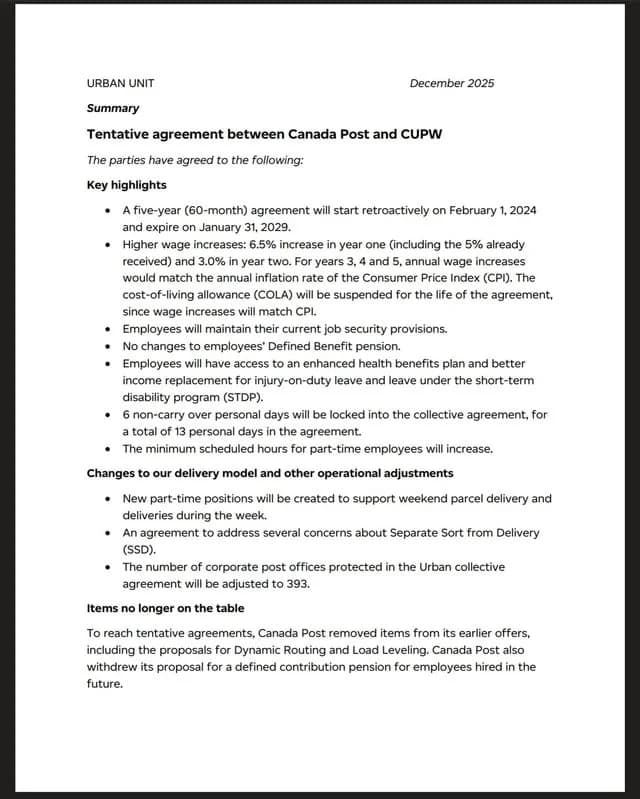

The December 22, 2025 tentative agreements include several material provisions designed to address compensation, benefits, and operational models:

- Term: Five years, expiring January 31, 2029 (Urban and RSMC). This long horizon provides stability for scheduling, budgeting, and workforce planning during a period of ongoing transformation. (canadapost-postescanada.ca)

- Wage increases: A 6.5% increase in year one (including a prior 5% already received) and 3.0% in year two; for years 3, 4, and 5, annual increases would align with the Consumer Price Index (urban and RSMC). This structure blends immediate recognition of cost-of-living pressures with a longer-run link to inflation. (canadapost-postescanada.ca)

- Pension: No changes to the Defined Benefit pension for Urban and RSMC. Pension protections remain a central anchor for many CUPW members and a notable point of continuity within a broader modernization push. (canadapost-postescanada.ca)

- Health benefits and income replacement: Enhanced health benefits and improved income replacement for injury-on-duty leave and short-term disability. These enhancements aim to improve resilience for workers facing on-the-job risks and health events. (canadapost-postescanada.ca)

- Personal days: Six non-carryover personal days locked into the agreement, for a total of 13 personal days across the term. This is a tangible benefit feature intended to improve work-life balance. (canadapost-postescanada.ca)

- Weekend parcel delivery model: A new operating model designed to support weekend parcel delivery, a critical adjustment as parcel volumes grow and weekend demand intensifies. (canadapost-postescanada.ca)

- Job security and protections: The agreement preserves current job security provisions for Urban employees while enhancing protections for RSMC employees; there are also adjustments to the number of protected corporate post offices (393). These elements reflect a nuanced approach to adapting staffing and facility protection during transformation. (canadapost-postescanada.ca)

- Compensation mechanics by unit: RSMC staff are positioned to transition to an hourly rate of pay, signaling a shift in how shifts and hours are structured in a more flexible, output-driven environment. The Urban unit maintains a worker-focused framework with strong pension and benefits protections. The distinction is significant for budgeting, scheduling, and workforce planning across both units. (canadapost-postescanada.ca)

Ratification process and timing

The union will manage a ratification vote for CUPW-represented employees. The parties agreed not to engage in strike or lockout activity during the ratification period, underscoring a mutual interest in preserving service continuity as workers assess the proposed terms. While the official Canada Post release does not specify a precise ratification date, the corresponding press coverage and industry reporting indicate that votes would occur in early 2026, subject to CUPW’s internal processes and CIRB administration. The ratification process is a crucial gatekeeper: even with tentative agreements in place, the final step rests with member approval. Reuters reported that both sides had agreed on the main points but still needed to finalize contractual language before the vote would be administered to CUPW members. The precise timetable for the ratification vote remains subject to CUPW and CIRB scheduling, but the path toward a vote appears clear. > “Both sides have agreed on the main points of the deals, but we need to agree on the contractual language that will form the collective agreements that would be put to a vote by the members,” CUPW said. (reuters.com)

Section 2: Why It Matters

Economic and workforce implications

Worker outcomes and financial implications

The December 22, 2025 tentative agreements mark a meaningful uplift in compensation and benefits for Canada Post employees, particularly at a moment when the company has faced financial strain and a changing demand mix. The 6.5% wage increase in year one (with 5% already received) plus a 3.0% increase in year two, followed by inflation-based increases in years 3–5, represents a blended approach to price and performance pressures. For workers, this translates into a more predictable wage trajectory tied to inflation, which is particularly relevant for employees facing rising costs of living. For Canada Post, this package aligns wage growth with projected parcel volumes and the need to recruit and retain skilled workers during a period of transformation. The terms are consistent with the company’s public communications about balancing competitive compensation with ongoing delivery-model adjustments aimed at improving service reliability and efficiency. (canadapost-postescanada.ca)

The enhancements to health benefits and injury-on-duty income replacement address worker welfare and operational continuity, reducing the likelihood that health or injury-related absences would disrupt service during peak periods. The inclusion of six additional personal days (for a total of 13) supports employee well-being, which in turn can influence recruitment, retention, and morale as Canada Post reorganizes its network. These provisions reflect a broader pattern in large public-sector and crown- corporation settlements where benefits improvements are paired with productivity and flexibility measures to stabilize operations. (canadapost-postescanada.ca)

Operational changes and service implications

A cornerstone of the tentative agreements is the introduction of a weekend parcel delivery model and the move to an hourly pay structure for RSMC employees. The weekend delivery component responds directly to the growth in parcel volumes tied to e-commerce, where customer expectations increasingly demand seven-day service windows. The hourly wage framework for RSMC staff suggests a more flexible shift architecture, potentially enabling more predictable scheduling, better coverage, and a more scalable response to weekend demand. These changes can influence delivery times, route optimization, and overall service reliability, which are central concerns for customers and businesses relying on Canada Post for timely shipments. (canadapost-postescanada.ca)

Broader labor relations context

The November 2025 discussions that preceded the finalization of the tentative agreements occurred amid a broader spell of labor activity, including prior strikes and government-ordered transformations as part of the post-pandemic logistics realignment. The Reuters report documenting deals in principle underscores the tension and the commercial stakes involved, including the fact that CUPW maintained the right to strike until ratified agreements are in place. The December 2025 development, therefore, sits within a broader arc of labor actions, policy interventions, and strategic restructuring that has characterized the Canada Post-CUPW relationship over the past two years. The ratification process will be a key test of workers’ acceptance of the proposed terms and of CUPW’s strategy for balancing member expectations with the company’s financial realities. (reuters.com)

Impacts on customers and market dynamics

Service quality and reliability during the transition

With a new weekend parcel delivery model and a more formalized weekend coverage strategy, Canadians and businesses can expect improved parcel handling and more predictable service on weekends, a historically critical capacity for e-commerce orders and holiday shipments. The changes to scheduling and the move toward hourly pay for RSMC may influence overtime control and crew scheduling, potentially reducing last-minute staffing gaps and enabling more stable delivery patterns. In the near term, the ratification process and the avoidance of strike/lockout actions should help maintain service continuity, particularly during the holiday peak season. The public statements emphasize that no industrial action is planned during ratification, which is an important signal to customers who rely on consistent service during the shopping season. (canadapost-postescanada.ca)

Competitive and policy context

Canada Post operates in a market with rising private parcel competition and evolving consumer expectations around delivery speed and reliability. The IIC’s review and subsequent Canada Post and CUPW negotiations reflect a broader effort to modernize the delivery network while preserving essential worker protections and pension commitments. This tension—between modernization and social protections—shapes Canada Post’s market positioning and public perception. The IIC findings, which highlighted the need for a redesigned delivery model and a sustainable financial path, provide critical background for interpreting the terms and potential implications of the tentative agreements. As service levels adjust to new operating models, observers will watch for how these terms translate into tangible performance metrics, including on-time parcel delivery, customer satisfaction, and cost efficiency. (canadapost-postescanada.ca)

Section 3: What’s Next

Ratification timeline and process milestones

The path to formal ratification

The December 22 tentative agreements place Canada Post and CUPW on a clear but still unfolding path toward formal ratification by CUPW members. The union’s ratification process will involve a member vote administered under the Canada Labour Code via CIRB processes. The timeline for the vote is contingent on CIRB scheduling and CUPW’s internal planning, but multiple industry reports indicate that votes were anticipated in early 2026. It’s important to note that ratification is the definitive step that turns tentative agreements into binding contracts for the five-year term. Until the vote passes, both parties retain the right to adjust operational practices as they see fit within the framework of the current collective agreements. The initial December announcement emphasizes that strike or lockout actions will be suspended during ratification, a practical measure to preserve service continuity while workers decide. (canadapost-postescanada.ca)

What to watch in the weeks ahead

- Ratification vote results and any required language finalization: The core channel to finalize the agreements is the CUPW ratification vote, with CIRB oversight. News outlets and company statements will likely provide updates on the vote schedule, turnout, and any delays in language alignment. The progress of contractual language finalization will determine whether any language edits accompany the ratification process.

- Implementation timeline for the new operating model: If ratified, Canada Post will begin the phased implementation of the weekend parcel delivery model and the hourly pay adjustments for RSMC employees. Observers should watch for pilot sites, scheduling changes, and the rollout schedule for the first wave of facilities where Dynamic Routing and weekend coverage are introduced. The May 2025 and May 28, 2025 Canada Post updates emphasize delivery-model changes and broader modernization elements, which will intersect with the December 2025 tentative agreements as they move to execution. (canadapost-postescanada.ca)

What happens next for stakeholders

Workers and CUPW leadership

CUPW leadership will assess the tentative agreement terms against member expectations, with a focus on wage growth, benefits enhancements, and protections that have historically been central to CUPW’s bargaining position. The union’s stance on ratification will reflect the balance between ensuring fair compensation and preserving employment protections within a changed operational framework. The union has previously signaled a desire to safeguard established protections while securing improvements in benefits and a more sustainable work arrangement. The December 2025 development includes explicit commitments to no strike or lockout during ratification, a factor that supports worker confidence in continuing to participate in the process. (reuters.com)

Canada Post and the broader public

For Canada Post, the tentative agreements provide a clear framework for workforce stability during a critical period of modernization and cost management. The five-year horizon aligns with financial planning cycles and capital investments associated with a delivery network planned for seven-day operations, while ensuring the company can maintain customer service expectations during peak periods. The company’s communications emphasize that the final terms are designed to align with IIC recommendations and to support a more flexible, resilient network. Observers will monitor how the agreed terms translate into service outcomes, employee retention, and the financial health of the Crown corporation as it navigates evolving e-commerce dynamics and public policy considerations. (canadapost-postescanada.ca)

Closing

The Canada Post CUPW tentative agreements December 2025 mark a defining moment in Canada’s postal landscape, balancing wage and benefit enhancements with a reimagined operating model aimed at weekend parcel delivery and more flexible staffing. The five-year terms, extending through January 31, 2029, provide a predictable framework for workers and the postal system as Canada recalibrates to a parcel-centric, seven-day delivery environment. As CUPW members prepare to vote, the broader public should expect a period of implementation planning, pilot projects, and ongoing communications about how the new terms will shape service levels, scheduling, and the customer experience. The outcome of the ratification vote will determine how these tentative agreements translate into long-term stability, efficiency gains, and continued commitment to delivering reliable postal services across Canada. (canadapost-postescanada.ca)

In the meantime, industry observers will continue to track performance metrics, labor relations dynamics, and policy developments that influence Canada Post’s strategic direction. As always, readers can expect ongoing coverage that connects the dots between wage settlements, operational changes, and service outcomes, helping Canadians understand not just what happened, but what it means for mail, parcels, and the people who make the system work.