Quebec 2026 Tax Indexing Purchasing Power Takes Effect

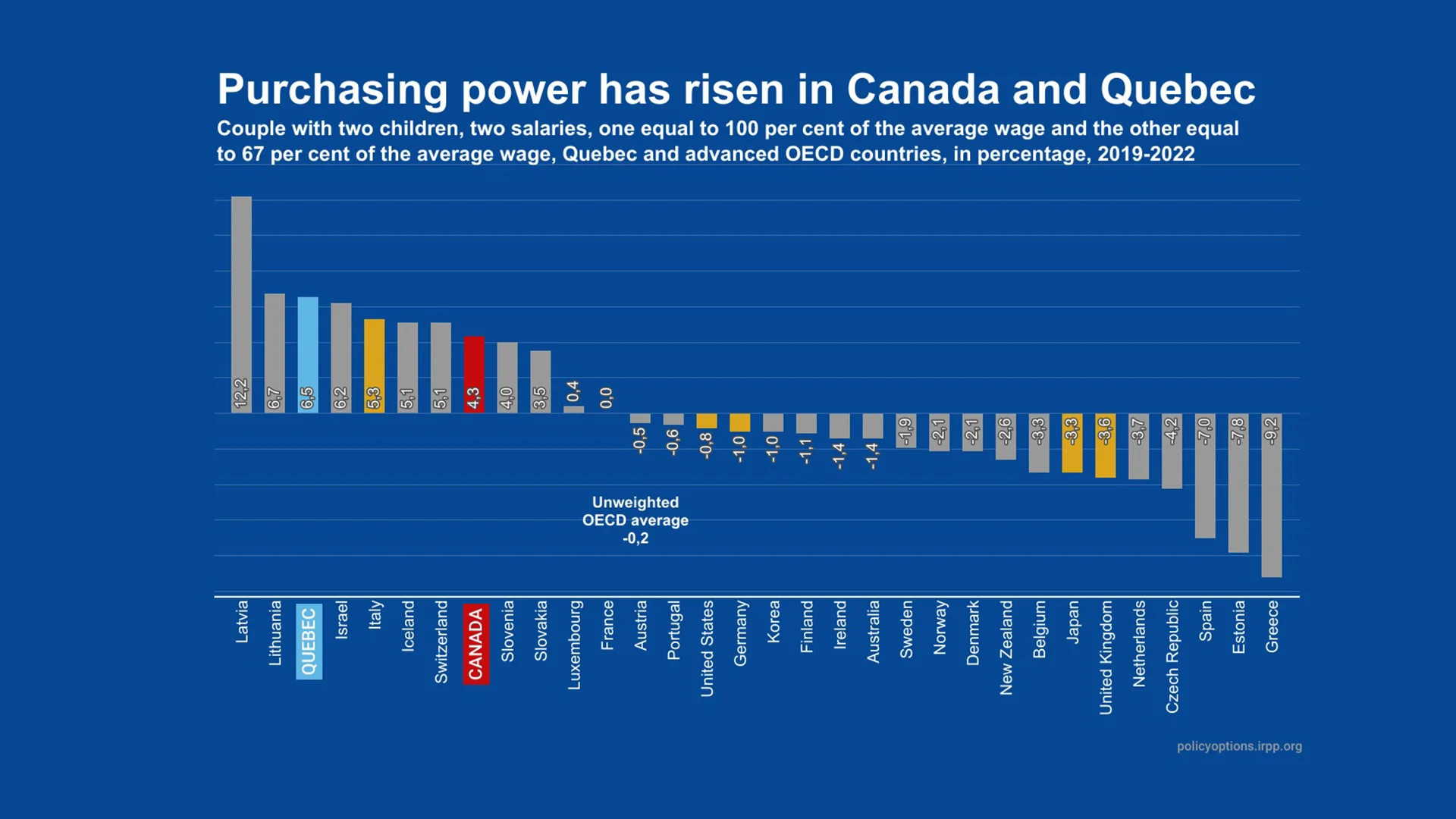

The fiscal policy unfolding for Quebec in 2026 centers on Quebec 2026 tax indexing purchasing power measures designed to shield households from rising costs. On November 25, 2025, the Ministère des Finances announced that the indexing rate applied to the parameters of the personal income tax system and social assistance benefits would be 2.05 percent, effective January 1, 2026. This move is framed by the province as a targeted effort to protect purchasing power amid ongoing inflation pressures and evolving economic conditions. For readers and businesses in Montreal and across Quebec, the change translates into immediate tax relief, with broader implications for budgeting, social assistance programs, and public finances in the years ahead. As the government stresses, this is part of a deliberate strategy to cushion households from price increases while maintaining fiscal balance, and it arrives with a clear five-year horizon for related fiscal gains. (quebec.ca)

The news arrives at a moment when households are closely watching how government measures translate into everyday purchasing power. The province’s update highlights a 2.05 percent indexation rate for 2026, a rate set within the framework of a cap on rate indexation at 3 percent through 2026. In practical terms, the 2026 indexation affects a broad swath of measures tied to the personal income tax regime and social assistance programs, adjusting them in line with changes in Québec’s consumer price trajectory. The government emphasizes that the indexation will yield a net gain for households and that the measure is designed to shield families from the eroding effects of inflation. This framing is complemented by data detailing the distribution of benefits—roughly $863 million in tax relief for individual taxpayers and about $68 million in additional social assistance—adding up to $931 million in purchasing-power protection for the 2026 taxation year. (quebec.ca)

Opening

Québec’s 2026 tax indexing purchasing power package is the centerpiece of a broader set of policy steps aimed at sustaining household resilience in a time of fluctuating price levels. The announcement from the Ministère des Finances underscores the core idea: as of January 1, 2026, the parameters governing the personal income tax system will be adjusted upward by 2.05 percent, aligning with consumer price trends observed in 2025. This adjustment translates into tax relief for individual taxpayers and enhanced supports for those relying on social-assistance benefits. The government underscores that the indexation is designed to maintain or improve the purchasing power of Quebecers, echoing a long-standing public-policy priority to reduce the real cost burden on households while maintaining essential public services. The size of the impact—$931 million in purchasing-power protection for 2026 and $4.1 billion over five years—is positioned by the government as a meaningful offset to cost-of-living pressures. This framing raises important questions about how the measure will play out in household budgets, in business planning, and across the broader economy. (quebec.ca)

In addition to the personal-income-tax related indexation, the government’s package includes other measures intended to support workers and families. Notably, starting January 1, 2026, Québec is implementing a reduction in contribution rates to the Québec Pension Plan (QPP) and the Québec Parental Insurance Plan (QPIP), a move the government says will deliver savings to workers over a five-year horizon. The combined effects of tax-indexing and pension program adjustments are framed as a comprehensive effort to bolster household disposable income and consumer purchasing power, even as policymakers monitor inflation and economic growth. This broader context helps readers understand why the 2026 indexation matters beyond a single fiscal year and how it interacts with other fiscal levers in the government's toolkit. (quebec.ca)

Section 1: What Happened

Announcement Details

-

The pivotal development is the formal indexing decision announced by the Ministère des Finances on November 25, 2025, setting the 2026 indexing rate at 2.05 percent for the parameters of the personal income tax system and social assistance benefits. The indexation is scheduled to take effect on January 1, 2026. This timing ensures that the new rates apply to the 2026 taxation year and to social-assistance calculations beginning early in the year. The official communication frames this change as a direct effort to protect purchasing power in Quebec. The 2.05 percent rate is presented as part of a multi-year policy path, with the government noting that the cap on rate indexation for certain government fees remains at 3 percent until 2026. (quebec.ca)

-

In English-language summaries and press releases, the government emphasizes the “protecting the purchasing power of Quebecers” objective, highlighting that the 2026 indexation reduces the tax burden and increases social-assistance adequacy in line with inflation. The press materials quantify the expected fiscal impact: $931 million in 2026 to protect purchasing power across households, including more than $863 million in tax relief to taxpayers and about $68 million in additional social-assistance funding. The five-year frame is also described, with the indexation contributing to longer-term household resilience as prices evolve. While the exact five-year totals vary by measure, the central message remains that the policy is designed to cushion families from price increases while maintaining essential public services. (newswire.ca)

-

The policy is framed within a broader tax-and-transfer context, with the 2.05 percent rate applied under the rules established by the Financial Administration Act and related policy directives. The government’s communications point to a long-run objective of stabilizing household budgets in the face of inflationary pressures and shifting consumer costs. The official materials also note that this rate is below the previously discussed cap of 3 percent, which has been used as a ceiling for rate-indexed measures through 2026. These design choices are intended to balance immediate relief with long-run fiscal sustainability. (quebec.ca)

-

The accompanying package also references broader economic considerations, including the plan to deliver further relief through other channels such as public pension indexation, wages, and targeted supports. While these elements are not the core of the 2026 tax indexing purchasing power story, they provide crucial context for understanding how the government envisions a coherent strategy to maintain household welfare and economic momentum. Analysts and readers should watch for cross-cutting announcements and updates from the Ministère des Finances and related ministries to track how these measures interact with evolving fiscal and macroeconomic conditions. (quebec.ca)

Key Numbers and Timeline

-

Effective date: January 1, 2026. This is the date when the 2.05 percent indexation for the parameters of the personal income tax regime and social-assistance benefits is to be applied. The timing is essential for taxpayers preparing for the 2026 tax year. (quebec.ca)

-

Indexation rate: 2.05 percent for 2026. The rate applies to most measures affecting individuals and social assistance benefits and is part of a broader indexing framework designed to reflect changes in the cost of living. The 2.05 percent rate is explicitly noted in the official release and subsequent summaries. (quebec.ca)

-

Estimated purchasing-power protection: $931 million for the 2026 taxation year. This figure captures the net effect of indexing on both tax relief and social assistance, representing the government’s prioritization of affordability. The breakdown includes approximately $863 million in tax relief for taxpayers and about $68 million in additional social assistance. The press materials emphasize the aggregate impact on households and the government’s commitment to maintaining purchasing power. (newswire.ca)

-

Long-run fiscal frame: $4.1 billion in purchasing-power protection over five years. The five-year horizon is cited in government communications as the cumulative effect of indexing and related measures on household welfare. This framing helps readers understand that the annual figure for 2026 is part of a longer programmatic commitment. (quebec.ca)

-

Cap on rate indexation: 3 percent cap on certain tariff indexations through 2026. While 2.05 percent will apply to many personal-income-tax measures, the government notes that the rate is bounded by a 3 percent ceiling for regulated tariff increases through 2026. This detail helps explain why the 2.05 percent rate may be more modest than earlier projections of possible increases in some contexts; it also clarifies the structure of the overall indexing framework. (quebec.ca)

-

Related policy move: QPP and QPIP contribution-rate reductions starting January 1, 2026. In addition to tax indexing, the government highlights a five-year plan to reduce contributions to the Québec Pension Plan and the Québec Parental Insurance Plan, a measure designed to further boost workers’ take-home pay and household budgets. The combined effect of these changes is presented as part of a comprehensive earnings-support strategy. (quebec.ca)

Scope and Limitations

-

The 2.05 percent indexation applies to the parameters of the personal income tax system and social-assistance benefits for the 2026 taxation year. It does not automatically translate into uniform increases across all government fees or all sectors of the economy; some tariffs are subject to a cap and other categories may be affected differently by policy design. The government’s communications emphasize the scope (tax regime and social assistance) and the limits (cap on some tariff-indexation rates). For readers, this means the direct impact will be most visible in tax filings and social-assistance calculations, with other government charges potentially following separate indexing rules. (quebec.ca)

-

The announcements do not claim universal or across-the-board increases; rather, they describe a targeted adjustment mechanism intended to preserve purchasing power. This distinction matters for households with different income levels, families with children, and recipients of social assistance, as well as for small businesses that rely on consumer demand and household disposable income. The government’s figures indicate overall gains but, as with any policy instrument, individual outcomes will vary according to circumstances. (newswire.ca)

-

The policy is framed as part of a longer-term affordability and growth strategy. While the immediate numbers provide a snapshot for the 2026 tax year, readers should monitor subsequent updates as the province publishes the official "Parameters of the Personal Income Tax System for 2026" and related guidance that outlines exact calculation methods and eligibility rules for specific credits, deductions, and benefits. The government points readers to these publications as the authoritative source of detailed computations. (newswire.ca)

Section 2: Why It Matters

Impact on Households and Taxpayers

-

The core of Quebec 2026 tax indexing purchasing power is to protect household budgets against inflation-driven cost pressures. By indexing the parameters of the personal income tax system at 2.05 percent, the government aims to preserve the net income of households and ensure that tax measures intended to ease the cost of living stay aligned with price changes. The official framing centers on a direct, quantifiable improvement in purchasing power for a broad cross-section of Quebecers. That is, the policy seeks to translate macroeconomic stabilization into tangible benefits for families and individuals as they manage daily expenses, debt service, and discretionary spending. The 2026 tax relief and social-assistance enhancements are designed to accumulate meaningful relief over time, reinforcing the idea that tax policy and social supports can function in tandem to support household resilience. (quebec.ca)

-

The 2.05 percent indexation also interacts with social-assistance programs, which serve some of the most vulnerable populations. The additional social-assistance funding linked to the 2026 indexing is framed as a targeted boost for those relying on safety-net programs, ensuring that basic needs coverage is not eroded by cost-of-living increases. Policymakers stress that these measures are essential to maintaining the social compact and reducing poverty risk in a period of inflation volatility. While the exact beneficiaries will vary, the published numbers indicate a clear monetary enhancement for program participants. (quebec.ca)

-

A distinct but related dimension is the policy package around QPP and QPIP contributions. The government’s plan to reduce these payroll taxes starting January 1, 2026, complements the tax-indexing initiative by boosting take-home pay for workers and reducing costs for employers. Over a five-year horizon, these payroll adjustments can have a meaningful cumulative effect on household budgets and consumer spending, potentially circulating through the economy as increased purchasing power supports demand for goods and services. Analysts and readers should assess how these wage- and tax-related changes interact with broader labor-market conditions, inflation trends, and consumer confidence. (quebec.ca)

-

The cap on rate indexation at 3 percent through 2026 is a crucial limit that shapes expectations. While the 2.05 percent rate is intended to align with inflation trends and preserve purchasing power, the existence of a cap implies that, in years with higher inflation, the indexation may not fully offset rising costs in certain domains. This design detail matters for households with high non-discretionary expenses, as well as for businesses that rely on predictable tax and transfer parameters for planning. The cap provides a check on rapid expenditure growth in the public sector while maintaining a predictable framework for households. (quebec.ca)

Broader Economic and Policy Context

-

The Quebec government has explicitly framed the suite of measures as part of a larger effort to safeguard the economy and household welfare in the face of inflation and macroeconomic headwinds. The “point on the economic and financial situation” communications highlight that the 2.05 percent indexing, along with other relief measures, contributes to long-run affordability and resilience for Quebec families. The emphasis on protecting purchasing power aligns with a broader policy narrative that ties fiscal policy to consumer welfare and economic stability, particularly in a province whose cost of living can be sensitive to energy prices, housing costs, and price indexes. (quebec.ca)

-

In parallel to tax indexing, the province’s broader financial management strategy includes cost-containment and targeted supports designed to maximize the efficiency and effectiveness of public spending. The combination of tax relief, social-assistance enhancements, and payroll-relief measures represents a multi-pronged approach to sustaining household income, improving living standards, and supporting economic activity. The government’s communications stress that the measures are designed to be fiscally sustainable over a five-year horizon, balancing immediate gains with long-term fiscal health. Readers should watch for updates to the fiscal plan, budget documents, and technical notes that detail the ongoing implementation and any adjustments based on actual inflation outcomes and macroeconomic performance. (quebec.ca)

Section 3: What’s Next

Milestones and Public-Policy Outlook

-

January 1, 2026 marks the central milestone for the 2.05 percent indexing in the personal-income-tax regime and social-assistance benefits. Taxpayers and social-assistance recipients should anticipate changes in their monthly withholdings, benefit calculations, and eligible credits beginning with the 2026 taxation year. Taxpayers may notice slightly higher take-home pay that reflects the tax relief built into the 2026 indexation, while those on social assistance will see adjustments in the monthly benefits. It will be important for households to review annual notices and communications from Revenu Québec and the Ministère des Finances to confirm how their specific credits and benefits are affected. (quebec.ca)

-

The 2026 indexing context sits within a broader five-year framework that includes QPP and QPIP contributions reductions starting in 2026. The government describes this as a longer-term effort to support workers and families by reducing payroll taxes and expanding effective take-home pay. Over the five-year horizon, the cumulative impact of these changes may become a meaningful part of household income growth, complementing the annual tax-relief figures associated with indexing. Stakeholders should monitor official updates as they unfold, since these measures can have compounding effects on household budgets and business payroll planning. (quebec.ca)

-

Policy publications and technical guidance are expected to accompany the 2026 indexing decision. The government notes that the authoritative details will be provided in the official documents, including the “Parameters of the Personal Income Tax System for 2026” and related guidance, which are made available through the Ministère des Finances’ publication channels. For readers seeking to understand the precise calculation rules, eligibility criteria, and credit interactions, these publications will be the primary sources. The public communications encourage readers to consult these documents to translate the high-level measures into individual outcomes. (newswire.ca)

What to Watch For

-

Inflation Trajectory and Indexation Adaptation: The cap on rate indexation and the actual inflation evolution will shape future decisions on annual indexing rates. If inflation diverges materially from expectations, policymakers may revisit the indexing framework, adjust caps, or modify the rate in subsequent years. Observers should watch the subsequent budget and finance department communications for any adjustment announcements. (quebec.ca)

-

Social-Assistance Adjustments and Equity Impacts: The social-assistance component of indexing aims to help the most vulnerable households, but real-world outcomes will depend on benefit design, eligibility rules, and program administration. Analysts should examine how benefit formulas interact with household changes in income, employment, and family composition in 2026 and beyond. (newswire.ca)

-

Employer and Employee Impacts of QPP/QPIP Changes: The payroll-contribution reductions starting in 2026 will affect take-home pay and employer payroll costs. Businesses should prepare for changes in labor cost structures, while workers should assess tax-withholding adjustments and potential changes in eligibility for related credits. The five-year horizon suggests gradual, predictable shifts rather than abrupt changes, but the cumulative effect could be material over time. (quebec.ca)

-

Public Communications and Public-Policy Transparency: As more technical guidance becomes available, the government will publish updated documents that detail how the indexing interacts with specific credits, deductions, and benefits. Readers should rely on official sources for the exact calculation rules and any transitional provisions that might apply to particular taxpayer groups. The government’s ongoing updates will shape public understanding and planning. (newswire.ca)

What’s Next for Montréal and Quebec’s Tech and Market Sectors

-

The Quebec government’s 2026 indexing and payroll-relief measures can influence technology and market-trends in several ways. For technology firms and startups operating in Montreal and beyond, a more predictable purchasing power environment can support consumer demand for devices and services, encourage investment in R&D, and influence hiring decisions as labor costs shift. For consumer-oriented tech sectors, modest improvements in household budgets can sustain demand for electronics, software, and network services. The policy narrative links these macro adjustments to the broader objective of supporting innovation, entrepreneurship, and a climate conducive to digital adoption. Analysts should monitor consumer confidence indicators, household disposable income trends, and sector-specific spending data to gauge the policy’s real-time impact on tech markets. (quebec.ca)

-

In the longer run, Québec’s approach to indexation, social supports, and payroll-relief measures could influence regional investment decisions, including the timing of capital expenditures, location choices for new projects, and talent retention strategies in Montreal’s tech ecosystem. Businesses and researchers should consider how the purchasing-power protection measures interact with inflation dynamics, demand volatility, and public-sector procurement policies. As policymakers publish more detailed guidance, market participants can refine forecasts for the next several fiscal years and align their capital plans with the government’s affordability objectives. (quebec.ca)

Closing

As the calendar turns to 2026, Quebec’s package around the 2026 tax indexing purchasing power stands as a central feature of the province’s fiscal policy. The 2.05 percent indexing rate, effective January 1, 2026, is designed to preserve household purchasing power by adjusting the personal income tax framework and social-assistance benefits in line with inflation. With a broader suite of measures—including QPP and QPIP contribution reductions and targeted social supports—the government presents a coordinated approach aimed at sustaining consumer welfare and economic resilience across Quebec. For readers in Montreal and across the province, the immediate implication is clearer budgeting and improved take-home pay for many workers, coupled with enhanced safety-net supports for the most vulnerable households. Over the coming months, readers should closely follow official publications from the Ministère des Finances and related ministries to understand the exact calculations and eligibility rules that will determine how the 2026 indexation translates into daily life. This coverage from Montréal Times will track further developments and provide updates as the official guidance becomes available. (quebec.ca)

—